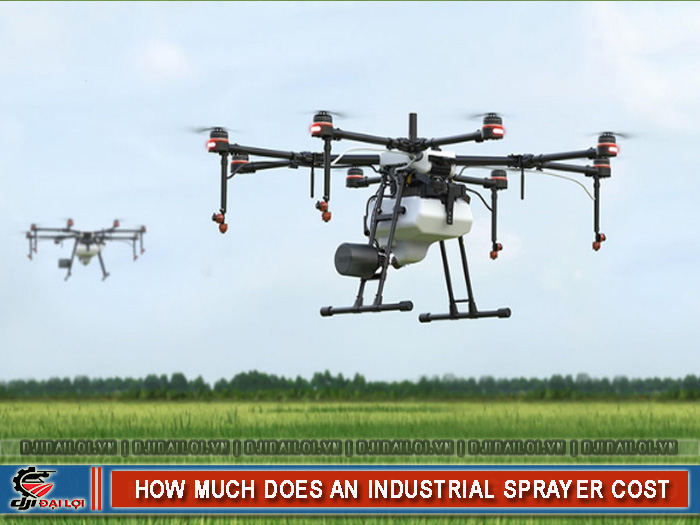

In recent years, industrial spraying drones have become a core tool in the smart agriculture ecosystem. With automated spraying capability, GPS navigation, and cloud-based data management, UAVs like DJI Agras or XAG P100 help farmers save up to 70% in labor.

According to the Institute of Agricultural Engineering, Vietnam’s agricultural UAV market has grown at an average rate of over 35% per year—reflecting the increasing demand for high-performance industrial spraying drones.

Agricultural cooperatives are undergoing major transformation toward centralized cultivation models. Investing in industrial crop spraying drones allows HTX to control crop cycles, reduce weather-related risks, and combat pests more efficiently.

Particularly, regional equipment-sharing models enable small cooperatives to access UAV technology benefits without heavy upfront investment.

While traditional hand-spraying requires 4–5 laborers per hectare, an industrial spraying drone can cover 20–30 hectares per day with just one operator. Industrial drones also ensure uniform spraying, reduce pesticide waste by up to 25%, and improve operator safety.

|

Model |

Tank Capacity |

Reference Full Set Price (VND) |

Note |

|---|---|---|---|

|

DJI Agras T30 |

30L |

~230–250 million |

Suitable for medium HTX |

|

DJI Agras T40 |

40L |

~270–300 million |

High efficiency, 6–8 ha/hour |

|

DJI Agras T50 |

50L |

~330–360 million |

Premium industrial model |

The table shows that the DJI Agras T40 offers the best balance between cost and real spraying performance, making it ideal for medium-sized cooperatives.

The XAG P100, a direct competitor to the DJI T40, is priced around 280–300 million VND. It features modular design and easy part replacement but has higher maintenance and accessory costs than DJI.

Overall, the average price of industrial spraying drones in Vietnam in 2025 ranges from 230 to 360 million VND, depending on brand and configuration.

Larger tanks and higher spray power mean higher prices. For example, a 30L model costs around 230 million, while a 50L version exceeds 350 million. Thus, industrial spraying drone prices scale with operational capacity.

Advanced drones with multi-directional radar and obstacle-avoidance sensors offer safer and more precise spraying, but also increase cost. The DJI Agras T50, equipped with Active Phased Array Radar + Binocular Vision, performs accurately even in strong wind.

Batteries make up 25–30% of a drone’s total cost. Industrial drone batteries recharge in 10–12 minutes but degrade after 400–500 cycles. Choosing high-capacity batteries and parallel charging stations directly impacts investment and maintenance costs.

Top brands like DJI and XAG have established service networks in Vietnam, reducing operational risk. Unofficial brands may be 10–20% cheaper but carry higher maintenance risks.

Before buying, cooperatives should determine crop type, average acreage per crop cycle, and spraying frequency. A drone is only “affordable” if its cost aligns with real productivity.

Select drones with precise spraying systems, low chemical consumption, and easy maintenance. The DJI T40, for example, uses one-third the fuel of older models.

Purchasing from certified dealers ensures genuine pricing, official warranty, and technical support—avoiding counterfeit or incomplete units.

Many HTX skip UAV operation training, leading to unnecessary damage. Ensure operators have at least basic flight certification and vendor-provided technical guidance.

The average investment for a single industrial drone (T40 or P100) is about 280 million VND, with a 2–3 year depreciation cycle. Clear financial planning ensures sustainable cash flow.

Smaller HTX can lease industrial UAV spraying services for 100,000–120,000 VND/ha, avoiding upfront purchase and maintenance costs.

Many authorized DJI and XAG dealers offer 0% installment plans or 5–10% discounts when buying with batteries and accessories—an ideal way to reduce initial expenses.

Using industrial spraying drones can increase spraying productivity up to fivefold while reducing chemical exposure by 80%. With 10 ha/day spraying cycles, profits can rise by 20–25% per season.

Depending on operational scale, cooperatives can recover their investment within 1–1.5 years through labor savings and improved productivity.

At Đức Lợi Cooperative (Gia Lai), after one year of operating the T40, spraying costs fell by 45%, crop cycles shortened by one-third, and pest control effectiveness improved by 20%.

HTX should choose drones with high spray efficiency, reasonable cost, reliable warranty service, and compatibility with local terrain.

Over the next 3–5 years, owning industrial crop spraying drones will become essential. Early investment boosts productivity, lowers labor costs, and enhances autonomy in production.

The right investment in industrial spraying drones not only empowers cooperatives to manage crop cycles effectively but also strengthens their competitiveness in the era of smart agriculture.

Industrial drones have larger tanks (30–50L), advanced radar systems, and continuous spraying capability across large areas, while consumer drones suit small farms only.

Only if the origin is clear, flight hours are low, and it still carries a valid warranty. Although 20–30% cheaper, risks with battery and sensor wear can raise maintenance costs.

Yes. Prices tend to rise slightly before the Winter-Spring and Summer-Autumn seasons due to high demand. Buying mid-season or year-end often yields better discounts.

Investments become efficient at around 50 hectares and above. For smaller areas (under 30 ha), leasing UAV services is more cost-effective.

Purchase from authorized DJI or XAG distributors to ensure genuine pricing, official parts, and operator training. Major distributors also offer 0% installment or extended warranties.